Why Choose JRI?

The team at JRI are committed to providing a high level of service centered around knowledge, expertise, honesty, empathy, and integrity. These qualities are essential in the insurance industry, where clients rely on professionals to navigate complex policies and provide guidance during challenging times. By going the extra mile to ensure a personal and professional service, JRI not only meets but exceeds the expectations of its clients. This dedication fosters trust and long-term relationships, which are invaluable in the insurance business.

Commercial and Personal Lines

JRI's brokers take the time to understand the unique needs of each client, whether they are businesses or individuals. This personalised approach ensures that clients receive tailored insurance solutions that address their specific requirements. We don't just stop at finding the right insurance coverage, we continue to work with clients as their insurance advocates, providing ongoing support and assistance. This commitment ensures that clients have peace of mind knowing their insurance needs are being actively managed.

As businesses or personal assets evolve and change over time, JRI remains proactive in updating insurance coverage to reflect these changes. This adaptability ensures that clients are always adequately protected against potential risks.

Life, Health and Disability

JRI Life Limited's advisers specialise in a range of risk insurance products, including life, trauma, health, and disability insurance. This expertise allows them to offer in-depth advice and guidance to clients seeking protection in these areas.

The advisers at JRI Life Limited work closely with clients to understand their unique financial and health requirements. By doing so, they ensure that clients receive appropriate protection that aligns with their specific circumstances, whether it's for their family or business. We recognise that circumstances change over time, whether due to personal or business-related factors and as such, we commit to regularly reviewing clients' insurance cover and adjusting it accordingly to ensure it remains suitable and effective.

Our Services

Whatever the size or scope of your business and/or personal affairs, JRI can take care of your business and personal insurance needs.

JRI has access to a broad range of insurance products to cover your assets and liabilities. Our broker team provides our clients with expert advice and source insurers and insurance policies that suit individual circumstances and preferences.

The personal lines and life insurance products we offer are supplied by leading insurance providers, meaning we can find the right policy for you and your situation.

Business Insurance

- Annual Corporate Travel

- Business Interruption

- Carriers Liability

- Commercial Motor Vehicle including Fleet and Heavy Haulage

- Commercial Property - Buildings/Plant and Contents/Stock

- Construction Works

- Cyber Liability and Privacy Protection

- Directors and Officers' Liability

- Employers Liability

- Employment Disputes Liability

- General and Products Liability

- Internet Liability

- Machinery Breakdown

- Professional Indemnity

- Rural Package

- Statutory Liability

- Trustees Liability

Personal Lines Insurance

- Home

- Lifestyle Blocks

- Contents

- Vehicle

- WaterCraft & Boat Insurance

Specialty Vehicles

- Classic, Collectible & Unique Cars

- Classic, Collectible, Off-Road Motorbikes & Scooters

- Motorhomes, Caravans, Converted Buses & Pop-Tops

- Race Cars and Motorbikes

Risk Insurance

- Life Cover

- Critical Illness (Trauma)

- Income Protection

- Disability Cover

- Health Insurance

Claims

The Strength You Need

JRI Limited is a member of the Steadfast Group - the largest insurance broker network in Australia and New Zealand.

Comprised of 458 brokerages spread across more than 1,880 offices, the Steadfast Group generated over AUD$8.3 billion in sales in FY20. This scale gives Steadfast flexibility and influence when negotiating with major insurers on behalf of Steadfast brokers and results in us being able to provide our customers with access to multiple insurance companies, a broad range of products, competitive pricing and valuable advice.

As a member of the Steadfast Group network, JRI offers you local and personalised service, backed with the resources and support of a large organisation.

Scope of Service

We provide advice on gernal insrace produts to help you protect your assets and liabilities to minimise the financial impact when things go wrong.

|

Recommendations based on your circumstances and needs |

Insurance products and providers |

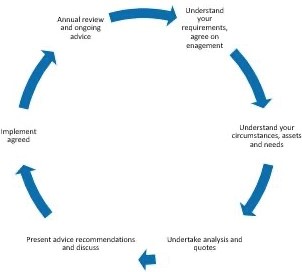

| We will complete a needs analysis with you to understand your business circumstances and make recommendations to provide you with adequate cover. An example of our process is shown below. |

Following our discussions, we will provide details on the identified insurance products and insurers

|

|

What we don't advise on

JRI Limited are a Financial Advice Provider licenced to provide advice on General Insurance products. We do not provide advice on Medical or Life Insurance, or any other Financial Advice products. JRI Life Limited are an Authorised Body of JRI Limited licenced to provide advice on Medical and Life Insurance products. We do not provide advice on General Insurance products, or any other Financial Advice products. |

|

Limitations and risks

Insurance cover recommendations will be based on the information you provide and there will be a risk of lack of cover should the information you provide not be accurate. While our recommendations will be made for your requirements, insurance products can have a number of exclusions that you should be aware of and you must read the policies carefully. |

|

|

Circumstances change

As your circumstances change (e.g. as you acquire new assets) it is important that you notify us to ensure the cover still meets your needs. |

|

Making Payments Easy

This overview relates to premium payments for all Business or Personal Lines covers and does not include Life, Disability, Income Protection, Health or Critical Illness Covers.

To ensure your cover is operative, we require payment on or before the policy renewal date. There are three easy ways to pay your insurance account. Credit terms other than through Premium Funding are strictly 30 days unless otherwise agreed by us.

PLEASE NOTE: If an invoice is unpaid by the due date we are obliged to notify the insurer who may cancel the contract and charge a short-term premium for the time they insured the risk.

1. Instalment Payment Option

Insurance premiums are required to be paid annually upfront, however to alleviate any financial pressures, you can choose to spread your annual insurance costs over easy to manage monthly instalments via Premium Funding.

What is Premium Funding?

Essentially this is a short-term loan that allows you to pay your annual insurance premium across 12 monthly instalments. This involves completing a Premium Funding Agreement* and a direct debit form and once approved the premium funder will pay your annual insurance premium direct to the insurer and you make monthly repayments to the premium funder. The premium funder we use to supply this service is Elantis Premium Funding (Elantis) a division of Arthur J Gallagher New Zealand Limited.

*Interest on the loan and an administration fee apply. These rates will be provided to you in a quote however please talk to your broker if you have any questions.

2. Direct Credit – Annual Payment

Pay your insurance directly into our bank account:

| Bank | Westpac |

| Name | JRI Limited |

| Account | 03-0713-0537019-000 |

| Reference | Please use invoice number and/or client ID |

3. Credit Card/Eftpos/Debit Card

We accept payment by credit card, however please note that a merchant fee of 2.2% applies and this will be added to the total invoice amount should you pay by credit card. We do not receive any income from the merchant fee.

Eftpos transactions do not incur an additional charge.

Please note that when a debit card is used without being physically present and/or without a pin number, the machine treats it as a credit card and will therefore incur the 2.2% surcharge.

How We Get Paid

This section details what we will charge for our services and other remuneration we may receive. If you have any questions about this please contact your broker.

Fire and General (Commercial and Personal Lines)

Premium Funding Commission

We are eligible to receive a commission from Elantis Premium Funding (Elantis) a division of Arthur J Gallagher New Zealand Limited in the event that you fund your insurance premiums. The commission is based on a percentage of the total insurance premium amount and an administration fee. We will provide you with more specific details of this commission should you decide to fund your insurance premiums through Premium Funding.

Life, Health and Disability

Risk clients are not charged a fee at any time for any service provided.

JRI Life Limited is paid commission by the Insurers we do business with when we arrange your insurance, this is a percentage of the annual premium paid.

Premium Account

We operate a separate premium holding account in accordance with the requirements of the Insurance Intermediaries Act 1994.

Your Responsibilities

You have a duty to disclose certain information to the Insurer. This duty of disclosure applies before you enter into a contract of insurance for the first time, when you renew, when you vary or extend that contract, and at any time your circumstances change during the period of insurance.

When you enter into a particular contract of insurance with the insurer for the first time, you will be asked to answer specific questions on the insurance proposal form. You must answer these questions truthfully and accurately to comply with your duty of disclosure.

On renewal, you are expected to disclose to your insurer every matter that you know, or could reasonably be expected to know, that may be relevant to the Insurer’s decision whether to accept the risk and on what terms.

You do not have to disclose anything that:

- Diminishes the risk to be undertaken by the Insurer;

- Is common knowledge;

- Your Insurer knows, or in the ordinary course of its business, ought to know; or

- Your Insurer has waived your obligation to disclose.

- If you do not comply with your duty of disclosure, the Insurer may be entitled to reduce their liability in respect of a claim or they may be entitled to cancel your contract of insurance.

- If the non-disclosure was fraudulent, the Insurer may be able to void (or cancel) the contract of insurance from its beginning. This would have the effect that you were never insured.

One important matter to be disclosed is the history of losses suffered by the person seeking insurance or any closely associated person or entity. Since you are responsible for checking that you have made complete disclosure, we suggest that you keep an up-to-date record of all such losses and claims.

If you have any questions about whether information needs to be disclosed, or want additional help, please contact us.

Not Happy?

At JRI we take our obligations to you very seriously. We think most issues can be resolved by talking to each other, however, if you want to escalate an issue beyond your broker or the claims specialist please contact our Office Manager directly.

We will endeavour to resolve any issues as quickly as possible. If the issue is not resolved to your satisfaction you will be referred to our disputes resolution scheme provider, this service will cost you nothing and will help us resolve any disagreements.

Financial Disputes Resolution Service

|

Participant Number

|

JRI Limited: FM5270

JRI Life Limited: FM6186

|

| Telephone | 0508 337 337 |

| enquiries@fdrs.org.nz | |

| Website | www.fdrs.org.nz |

|

Address

|

PO Box 2272

Wellington 6140

|

Need to Know

Your Privacy

We will keep all information you provide us about your or your business confidential and only disclose it in the normal course of negotiating, arranging and administering your insurance and, except where disclosure is required by law or where the information is already in the public domain.

Any personal information that you provide to JRI Limited and/or JRI Life Limited will be held by JRI Limited at 177 Courtenay Street, New Plymouth, New Zealand or at Unit 4, 9 Sir Gil Simpson Drive, Burnside, Christchurch.

If you are an individual, the Privacy Act 2020 gives you the right to request access to, and correct your personal information that JRI Limited holds. For our full Privacy Statement please click here.

If you have any questions regarding our Privacy Statement or would like to access, correct and/or change the information collected at any time then please contact us.

Contacting Us

You can contact us in person, by telephone, letter or email. Contact information for all our people is available on our website under The Team.

Disclosure Statement

For all business and renewals your broker will provide you with a disclosure statement. This statement confirms you are working with a registered Financial Adviser and that you have access to a disputes resolution service. You will find the link to our disclosure statement as part of their email signature or you can click here.

Consent - Regulatory Body Review

By signing a Broker Authority with JRI Limited this confirms that you consent to Regulatory Body reviews of our records and your personal information, should it be required. The sole purpose of any such review and release of information to a Regulatory Body is to ensure JRI Limited are operating in accordance with the conditions of their Financial Advice Provider Licence.